Security

PCI Compliant Payment Gateway

WEBINC is a PCI DSS Level 1 compliant Payment Service Provider. PCI DSS stands for Payment Card Industry Data Security Standard which has been developed by the leading card schemes in 2004 to prevent misuse and theft of cardholder data. Compliance with PCI DSS is mandatory for any organization that stores, transmits or processes payment card transactions.

The Cardholder Information Security Program (CISP) and Site Data Protection Program (SDP) were the basis for PCI. PCI is supported by all major card brands in the industry. Each card brand continues to maintain its own compliance program and has the right to demand additional requirements and may assess fines for non-compliance. While using WEBINCs’ Payment Gateway you won’t need to be PCI certified as all sensitive data will be handled by our secure Payment Platform which can be easily integrated on your website. Anyway if help is needed our technical department is available at any time.

Fraud Prevention

WEBINC takes fraud protection very seriously as fraud might cause a big financial loss for a merchant. Especially E-commerce fraud has increased significantly in the past years. Therefore WEBINC offers several anti-fraud solutions for your online business to avoid theft and all kinds of credit card scams.

Anti-Fraud Solutions

Verified by Visa / MasterCard Secure Code (3D-Secure)

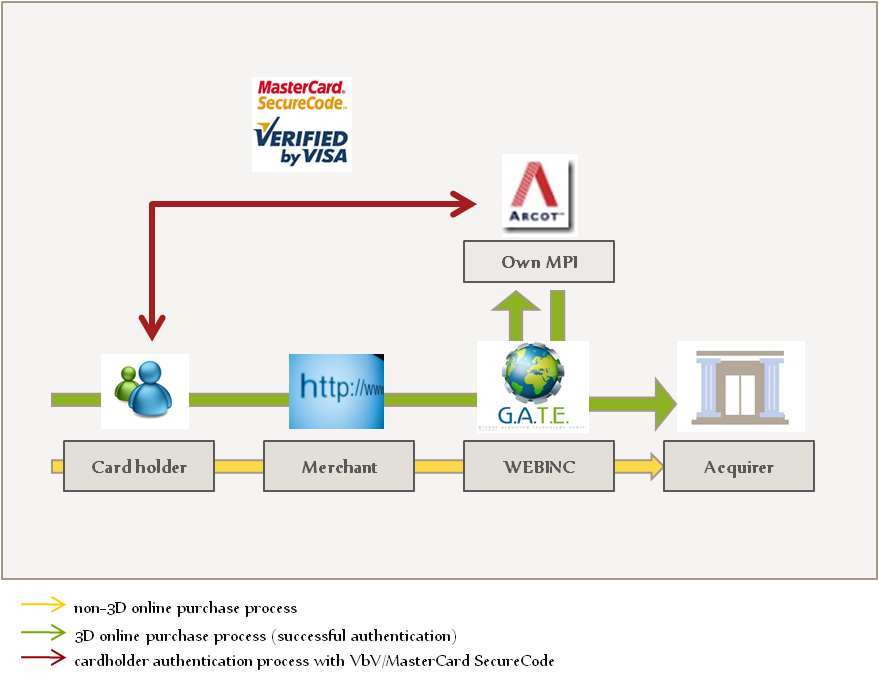

Visa and MasterCard have added an additional layer of security to online transactions by providing the services “Verified by Visa” and “MasterCard Secure Code.

Visa and MasterCard have added an additional layer of security to online transactions by providing the services “Verified by Visa” and “MasterCard Secure Code.

After the cardholder has initiated an online transaction he is getting automatically redirected to the website of his card issuing bank to authorize the transaction while entering a secret password tied to the used credit card.

The main benefit of these 3-D Secure Protections is the control of risk exposure for cardholders and merchants by reducing fraudulent transactions, cardholder disputes, charge-backs and cost of write-offs. If a Merchant does not use 3-D Secure, the Merchant is liable for fraudulent transactions, even if the transaction was properly authorized.

WEBINCs Payment Platform enables you to process 3D-Secure transactions through our own MPI (Merchant plug-in) which is fully registered with Visa and MasterCard.

Blacklisting

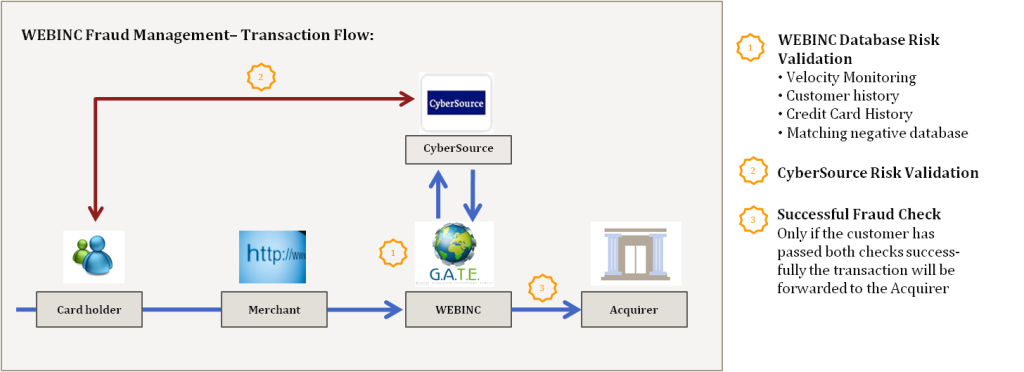

Due to our long time experience at the global e-commerce market, WEBINCs Payment Gateway System possesses a large database of customer history. Transactions which will be processed on our Payment Gateway System will be matched at first step with our negative database.

W.P.G. gives you the possibility to create and extend your own blacklist while blacklisting single credit cards, BINs, countries or complete customers.

Velocity Rules

WEBINCs Payment Gateway System provides you with the possibility to set additional limitations per merchant account which can be individually specified:

- New User Limitations (Volume/Transaction Limits per day, week and month)

- Limitation of maximum transaction amount

- Limitation of maximum transactions per day

Preauthorization

Preauthorization is the first part of a two stage transactional process.

A Preauthorization verifies that a card is valid and has sufficient funds to complete the initiated transaction. If a transaction has been approved, the authorized amount is held until it has been captured or an expiry time has been reached, which is usually 7 days for Visa and MasterCard and 14 days for American Express transactions.

CyberSource Risk Validation Services

Besides own Anti-Fraud Filter WEBINC is additionally using the following risk validation services of Cybersource which are optional for processing:

- IP Geolocation Check

- Neural net risk detection

- Check of Global telephone number

- Check of Global delivery address

- AVS, CVN Check

CVV2 / CVC2 check

CVC2 / CVV2 check is an important security feature for card-not-present transactions. The CVV2 /CVC2 is a three-digit number on Visa/MasterCard cards, four-digit on Amex credit cards and printed on the signature panel on the back of credit cards.

The CVV2 value helps to validate two things: The customer has their credit card in his/her possession and the card account is legitimate.

Ready to take your business to the next level?

Apply now online and start processing with WEBINC today!

Discover how WEBINC can revolutionize your payment processing experience with our secure, innovative, and sophisticated solutions.