Webinc

Your Global Partner for Secure and Innovative Payment Solutions

%

PCI Compliance in 2026

%

Data Security

%

Data Privacy

Ready to take your business to the next level?

Apply now online and start processing with WEBINC today!

Discover how WEBINC can revolutionize your payment processing experience with our secure, innovative, and sophisticated solutions.

Our Product

W.P.G. – WEBINC Payment Gateway

In addition to the technical connection to the acquiring bank WEBINC provides a highly developed and user-friendly administration tool which is including a multiplicity of different statistics and risk management features.

Read more

Credit Card Processing

WEBINC helps you to accept credit and debit card payments online which is always a problem for small to medium businesses as they are unable to acquire a suitable merchant account with their local financial institution.

Read more

Security is very important to us

PCI Compliant Payment Gateway

WEBINC is a PCI DSS Level 1 compliant Payment Service Provider. PCI DSS stands for Payment Card Industry Data Security Standard which has been developed by the leading card schemes in 2004 to prevent misuse and theft of cardholder data. Compliance with PCI DSS is mandatory for any organization that stores, transmits or processes payment card transactions.

3D Secure/VBV

Visa and MasterCard have added an additional layer of security to online transactions by providing the services “Verified by Visa” and “MasterCard Secure Code”.

After the cardholder has initiated an online transaction he is automatically redirected to the website of his card issuing bank to authorize the transaction while entering a secret password tied to the used credit card.

The main benefit of these 3-D Secure Protections is the control of risk exposure for cardholders and Merchants by reducing fraudulent transactions, cardholder disputes, charge-backs and cost of write-offs. If a Merchant does not use 3-D Secure, the Merchant is liable for fraudulent transactions, even if the transaction was properly authorized.

WEBINCs Payment Platform enables you to process 3D-Secure transactions through our own MPI (Merchant plug-in) which is fully registered with Visa and MasterCard.

Velocity Checks

WEBINCs Payment Gateway System provides you with the possibility to set additional limitations per merchant account which can be individually specified:

- New User Limitations (Volume/Transaction Limits per day, week and month)

- Limitation of maximum transaction amount

- Limitation of maximum transactions per day

And many more…

Pre-Authorization

Preauthorization is the first part of a two stage transactional process.

A Preauthorization verifies that a card is valid and has sufficient funds to complete the initiated transaction. If a transaction has been approved, the authorized amount is held until it has been captured or an expiry time has been reached, which is usually 7 days for Visa and MasterCard and 14 days for American Express transactions.

CVV, CVC, CVV2

CVC2 / CVV2 check is an important security feature for card-not-present transactions. The CVV2 /CVC2 is a three-digit number on Visa/MasterCard cards, four-digit on Amex credit cards and printed on the signature panel on the back of credit cards.

The CVV2 value helps to validate two things: The customer has their credit card in his/her possession and the card account is legitimate.

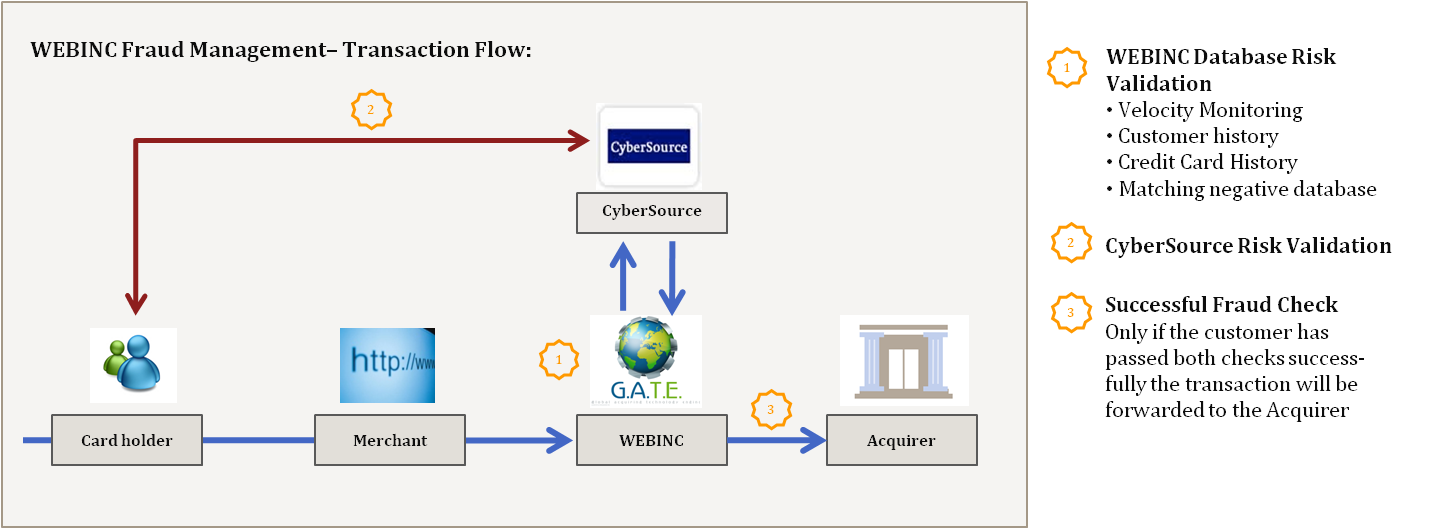

Cybersource

Besides own Anti-Fraud Filter WEBINC is additionally using the following risk validation services of Cybersource which are optional for processing:

- IP Geolocation Check

- Neural net risk detection

- Check of Global telephone number

- Check of Global delivery address

- AVS, CVN Check